Overview of Rediff Money

Rediff Money is a financial website (subsite) of rediff.com. This website contains all essential financial data about various stocks of the Indian stock market.

It gives all the segment-wise details of Indian stock market. It provides real-time charts of various charts and indices of the Indian stock market.

Rediff Money Wiz also covers the financial data of Mutal Funds in India and it also covers the forex market as well. This site is very famous for providing seamless real-time financial data.

This is a very useful website for people who are trading and investing in the stock market. It is also useful for people who are learning the stock market.

Do you want to know the full potential of this website? Let's dive in.............

Homepage of Rediff Money Wiz

The homepage of Rediff Money basically gives an overview of the market. Its interface is very easy to understand and very easy to use. The important features of the homepage are:

There is a sign-up button on the top right corner. You can sign up there with your email. If you sign up at the Rediff money Wiz, you will be able to use all its features.

Then, there is a search box named "Real-time Quote". Here, you can get the details of any stock or Mutual fund. Enter the name of the quote, the press on "Get Quote".

Then, there is a section which shows the live quotes of Sensex and Nifty with their charts. The gainers and losers of the respective exchange are also given beside their charts.

Then, the indices of every sector are given. The sectors are telecom, Oil & Gas, Energy, Power, Technology, Infra, Realty, Auto, Metal, Financial etc.

The real-time market news is also given at the right sidebar. You can get live news here. Rediff Money gives reliable news of the market upon which you can trust.

Then, there is a section of BSE Indices, here you can get live tick by tick value of all indices of Bombay stock exchange like S&P BSE Sensex, S&P BSE 100, S&P BSE 200, S&P BSE 500, S&P BSE MidCap etc.

Then, there is a section of NSE Indices, here you can get live tick by tick value of all indices of National stock exchange like Nifty 50, Nifty next 50, Nifty IT, Nifty midcap, Nifty 500, Nifty Bank etc.

Then, there is a section of "Live Market Indicators" at the right sidebar just below the "Real-time market news". Here, there are two sections i.e. Global and Domestic.

In "Live Market Indicators: Global", you will get the major global indices like Nasdaq, Hang Seng, Nikkei 225, S&P 500, Strait times, crude oil etc.

In "Live Market Indicators: Domestic", you will get the major domestic indices like SGX Nifty, Gold, Silver, IIP, FD Rates(SBI) etc.

Then, there is a section of "Corporate Announcements" at the right sidebar just below the "Live Market Indicators". Here you get the instant update of every major corporated announcement made by a major company.

There is also a section of "Most traded companies". Here you can get the list of most traded companies for that particular day. You will get the most active companies for the day.

In Rediff Money, there is also a section of "Top Market Capital Companies". Here you will get the descending list of Top market capital companies with their live share prices.

Various Features of Rediff Money

There are various features of Rediff money which makes it very useful websites for the people who want to invest in the stock market or they want to do any type of trading like swing trading, Intraday trading etc.

Some of its most important features are given below:

Rediff Money My portfolio

Rediff Money provides a very good service of maintaining your portfolio for free. It is a very phenomenal feature of the Rediff Money.

You have to click at the "My Portfolio" section at the homepage. Here you will be asked to enter the email address. If you have a rediffmail id, then enter that and if you don't have one, you can make a rediffmail id.

After entering the rediffmail id, a new window will open with the pop up "Name your portfolio". Here you have to enter the name of your portfolio. You can enter any name you like.

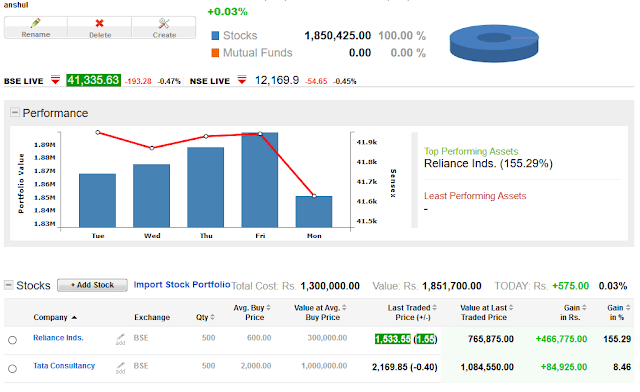

Here a pictorial view of your portfolio will open, it will show the current performance of your portfolio. You can add any stock or mutual fund here.

The performance of your portfolio will be given in the form of Bar graphs for the previous week. Beside the bar graph, the top-performing asset of your portfolio will be given.

The Doughnut chart of your portfolio will also be given here. It will basically give the information about the % of stocks and Mutual funds that you have in your portfolio.

Underneath the bar chart, the list of the stocks of your portfolio will also be given. Here, all the basic facts about your stock will be given like Exchange, Quantity, Average Buy price, Value at Buy price, Last Traded price, Value of your portfolio at Last traded price, Gain or loss and Gain or Loss %.

You can add any stock or Mutual fund in your portfolio. Click on "Add Stock" or "Add mutual fund" button, then you can add your required Mutual Fund or Stock.

Import Portfolio

This is the newest feature of the Rediff Money. You can import your previous other portfolios with the help of this cool feature.

This feature helps you to save your time by not creating the same portfolio again. Due to these cool features, Rediff Money is very popular among the investors in India.

Rediff Money My Watchlist

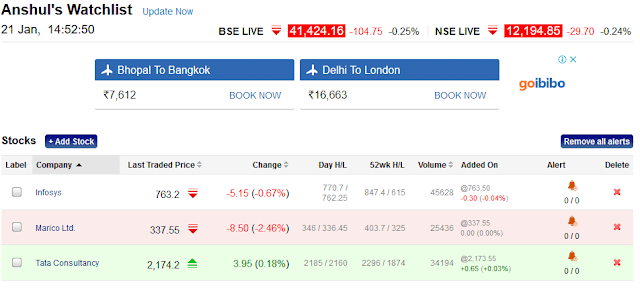

In this section of Rediff Money, you can create your watchlist for the stocks or Mutual Funds on which you have to make attention for the future.

It is very important to create a watchlist to watch the stocks that you want to buy in future. When you add these stocks to your watchlists, it is easy for you to track their movements.

It is very important to create a watchlist to watch the stocks that you want to buy in future. When you add these stocks to your watchlists, it is easy for you to track their movements.

Here, the entire list of the stocks or mutual funds of your watchlist will be available. The stocks with their last traded price, change, Day high or low, 52 weeks high or low, Volume, Alert etc. will be given.

You can also set the alert for stock here. To set an alert, click on the alert, set the price(above or below) for the particular stock, you are done.

Whenever that particular stock will go above or below the particular price, an alert or a message will be sent to your account immediately. This way, you don't have to continuously watch the screen.

The Rediff Money watchlist is responsive that means the watchlist will be viewable flexibly in mobile, desktop, tablet and IOS as well.

The Rediff Money watchlist is responsive that means the watchlist will be viewable flexibly in mobile, desktop, tablet and IOS as well.

Rediff Money Wiz: Investment Tool

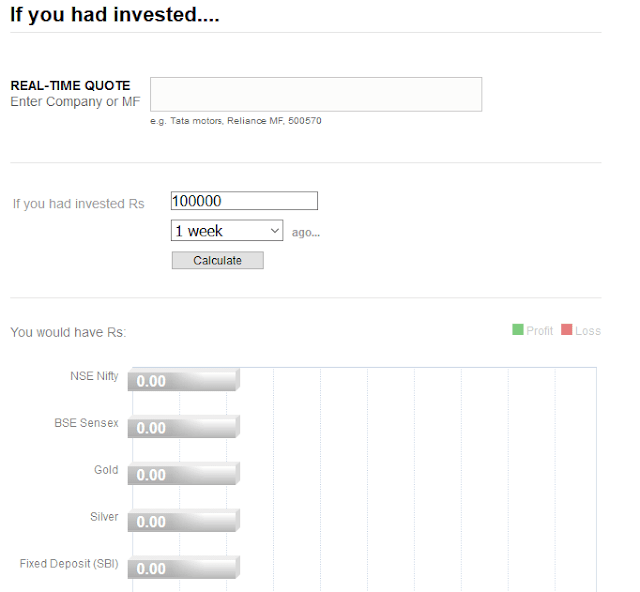

The "Investment tool" is a very useful tool if you want to know how much profit or loss you would have booked if you would have invested in the particular stock.

You can select any stock or mutual fund for which you want to know how much profit or loss you would have booked if you would have bought that stock or mutual fund.

Then, you have to put the amount and date for which you want to check. Then, click on calculate, you will get the unrealised amount of that particular stock.

You will also get the unrealised amount of your previous amount if you have invested it in the nifty, Sensex, gold, silver, Fixed deposit of the SBI as well. This tool is very unique and exclusive feature of Rediff Money.

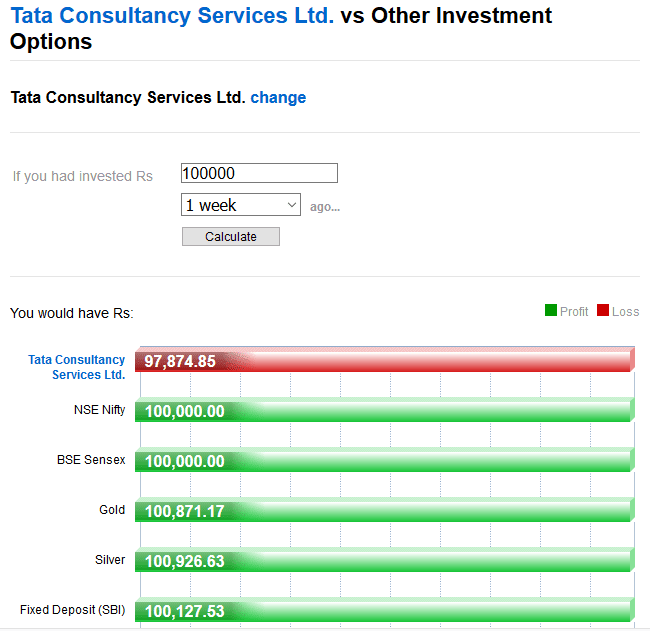

For example, if you have invested 1,00,000 Rupees in TCS one week before, you would have got 97,874.85 Rupees. You also get the amount if you had invested in Nifty, Sensex, Gold, Silver and Fixed deposit as well.

You would have got 100,000 Rupees if you had invested in NSE Nifty. You would have got 100,000 Rupees if you had invested in BSE Sensex. You would have got 100,871.17 Rupees if you had invested in Gold.

You would have got 100,926.63 Rupees if you had invested in Silver. You would have got 100,127.53 Rupees if you had invested in Fixed Deposit(SBI).

It is a very cool feature, Isn't it?

Rediff Money Wiz: Forex

The "Forex" section of the Rediff Money is simply a currency converter. you can convert your currency like Rupees, dollars etc. in various currencies of the world.

The rates of some of the major currencies of the world like USD, pound, yen etc. are given below in Indian Rupees(INR) in advance.

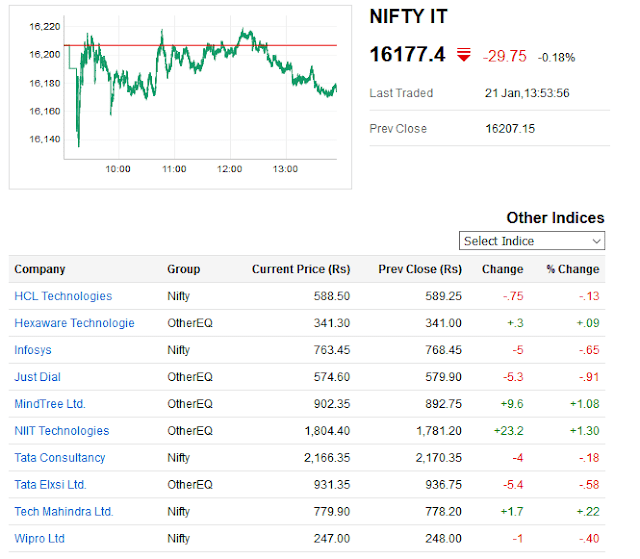

Indices

In this section, you will get the indices like Sensex, nifty, global etc. You will also get the full overview of a particular index like nifty 50, Sensex etc.

If you click on the nifty 50, a new window will open. It will contain the real-time chart of nifty 50 and its previous opening and closing prices.

You will also get the list of the constituents of that particular index. The real-time stock prices of those stocks will also be given with their previous close, change in value, % change etc.

In the same way, you can get all the details of any index like Sensex, nifty next 50, Nifty 100 etc.

Sectors

In this section, you will get the real-time indices of various sectors like Auto, Realty, IT, Banking, Insurance, Power, Energy, Oil & Gas etc.

If you will click on the Nifty IT, a separate window will open. It will have a real-time chart of Nifty IT and its previous closing prices.

You will also have the list of the companies of which the particular sector like Nifty IT is composed of. The real-time stock prices of those stocks will also be given with their previous close, change in value, % change etc.

Mutual Funds

In this section, you will get the list of top 25 mutual funds of the year arranged according to their return rate. Rediff Money has done phenomenal research on the mutual funds of India.

You can also apply the various filters like if you want to get the list of those mutual funds which give high returns(but they involve high risk as well), you just set the filter and you will get the result of all the mutual funds which gave high returns last year.

In the same way, you can apply the filter of medium risk, medium returns and low risk, low returns. It is a very cool feature since you will not have to work hard to find your required mutual fund with as per your risk appetite.

When you will click at the particular mutual fund from that list, a full overview of that particular mutual fund will open.

In this window, you will get the real-time price of that particular mutual fund with all its required details like entry load, exit load, required amount, popularity etc.

Conclusion

All-in-all, Rediff Money is a very great website for the stock market beginners and the experienced investors as well to maintain their portfolio, watchlist, for getting stock market news etc. for free.

Due to providing the quality information, people trust this website for all the financial data of the stock market and the Mutual Fund Market in India.

There are very few websites which cover the stock market and Mutual Fund market both efficiently and Rediff Money is one of them.

This website works better at desktop than the mobile. On the mobile, this website performs well but on the desktop, it will be more easy to use.

I hope you liked the review of the Rediff Money website. They are the personal thoughts of the author. Some of its features may change in future. So stay attentive.